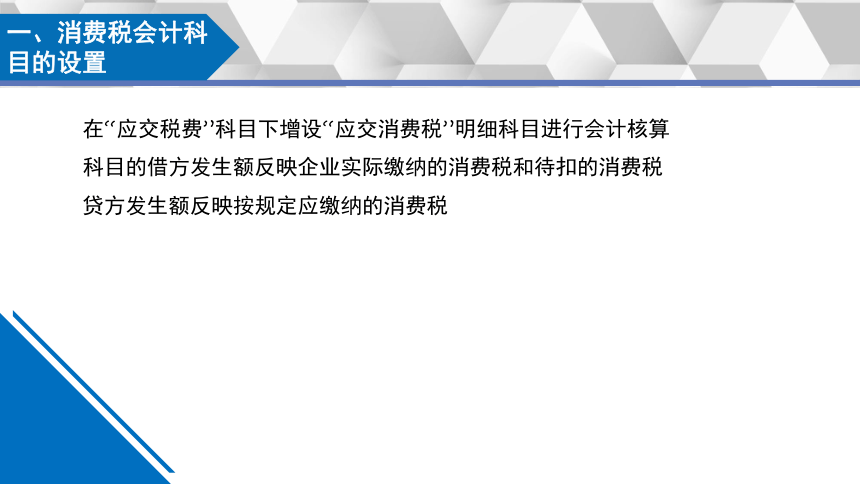

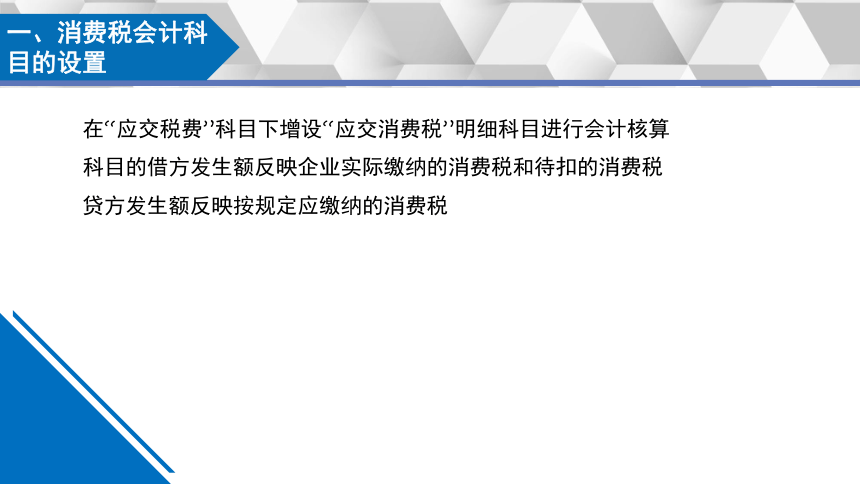

资源预览

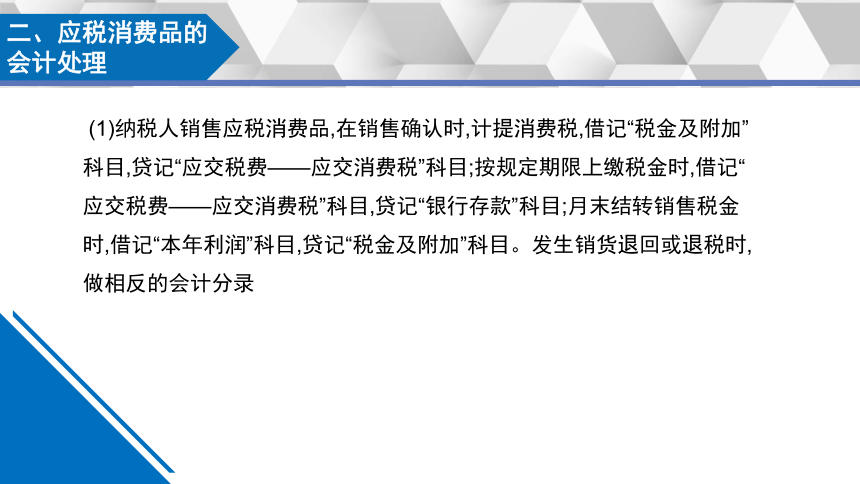

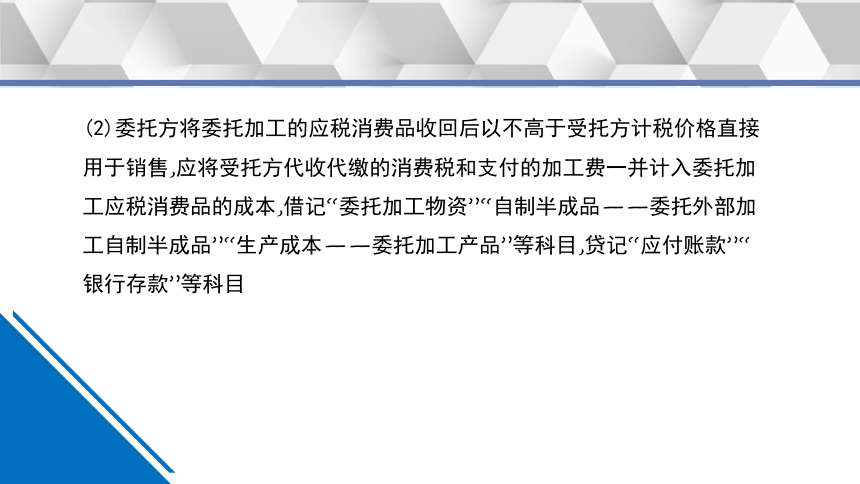

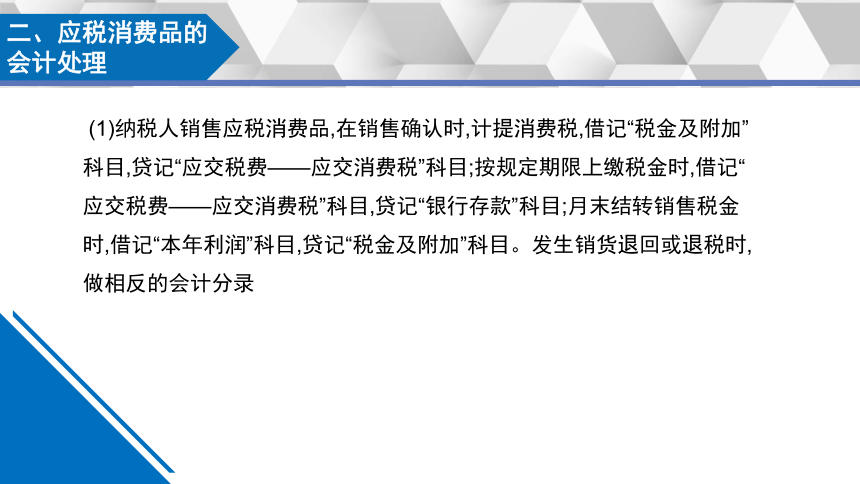

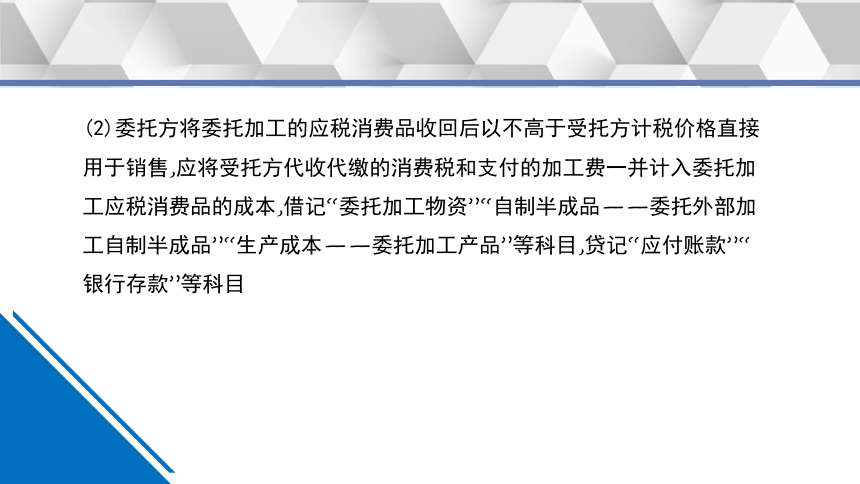

资源预览

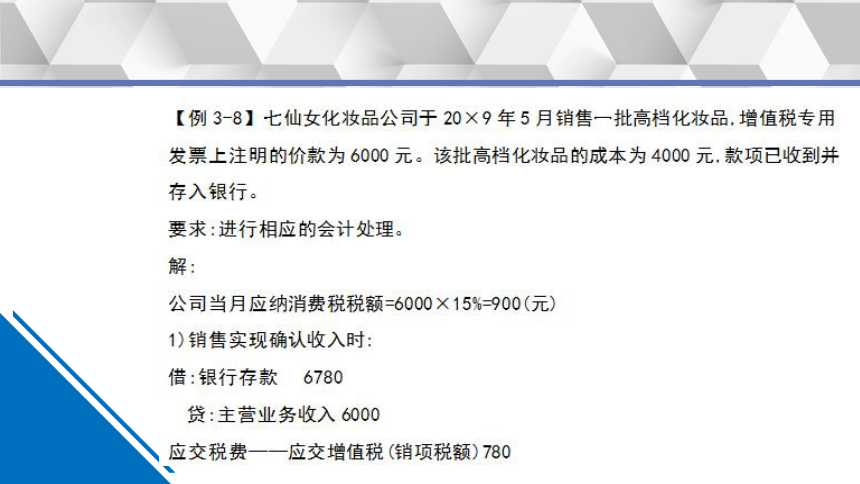

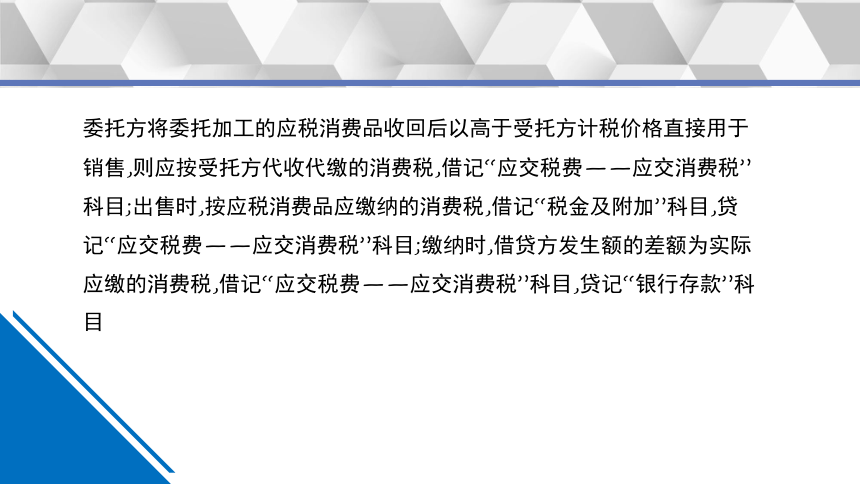

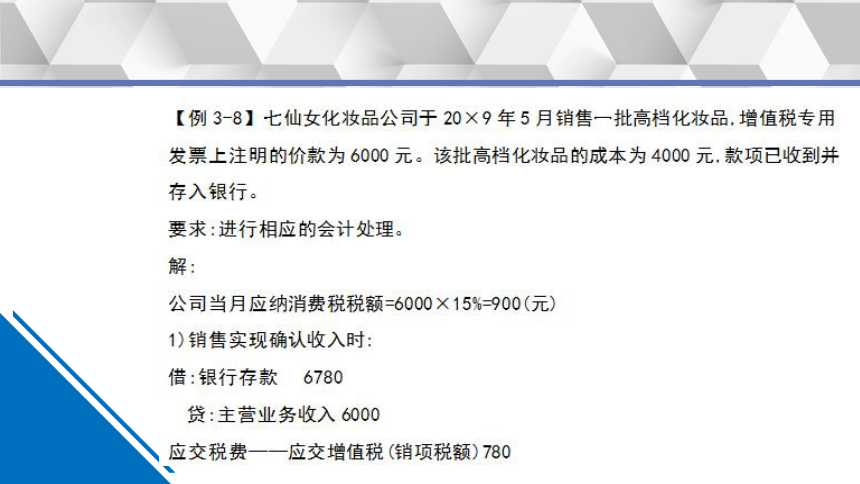

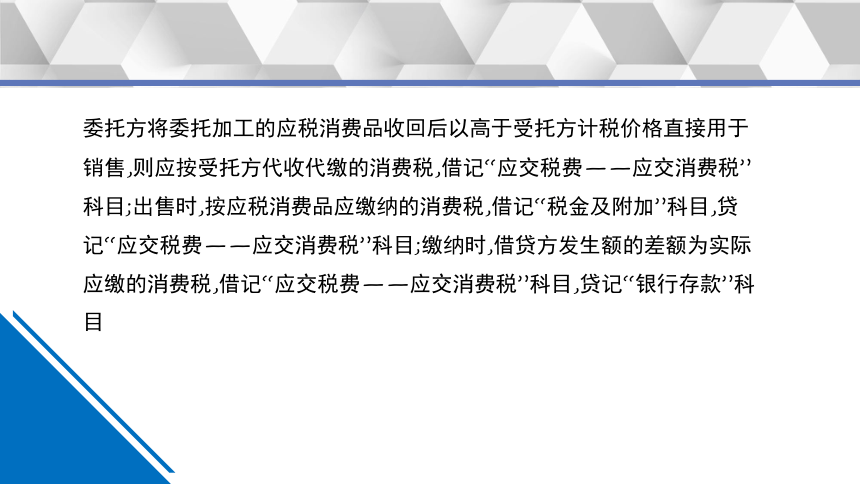

资源预览

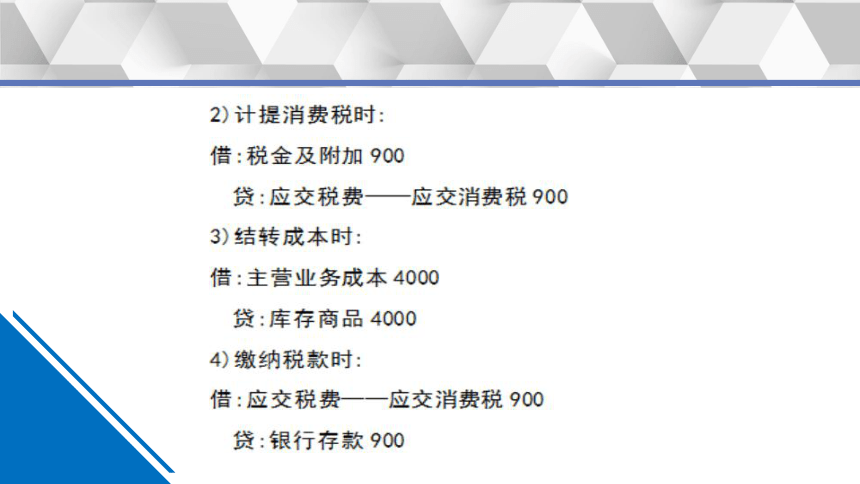

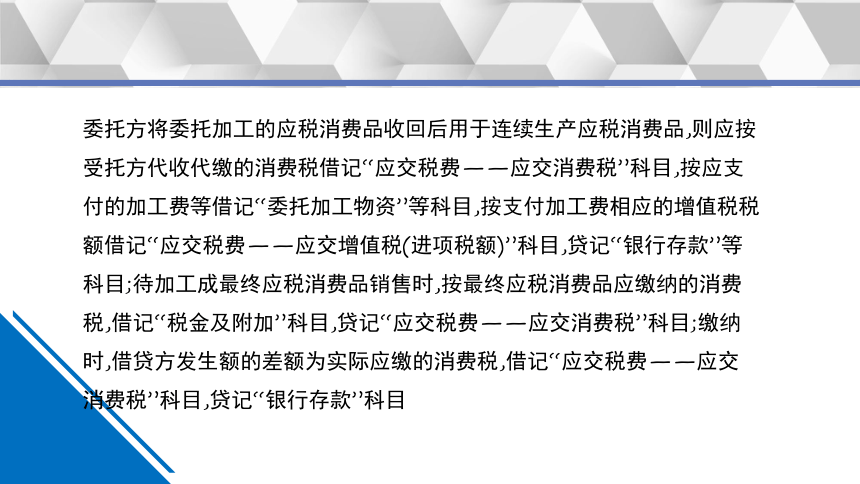

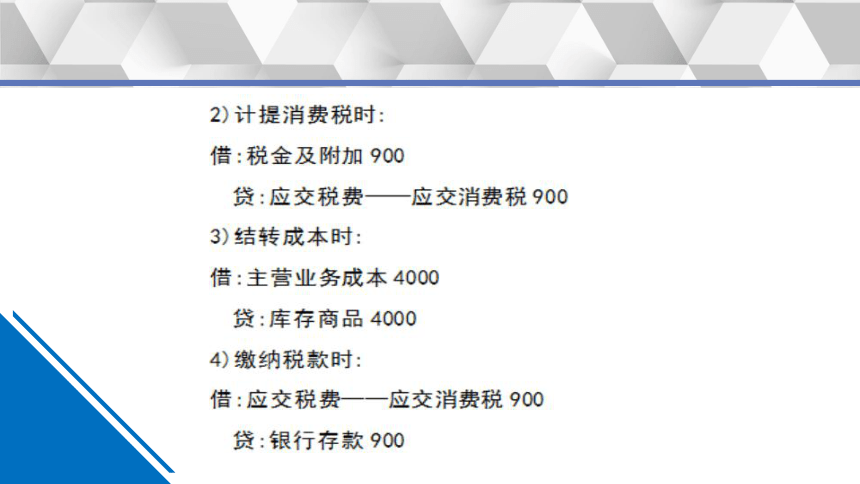

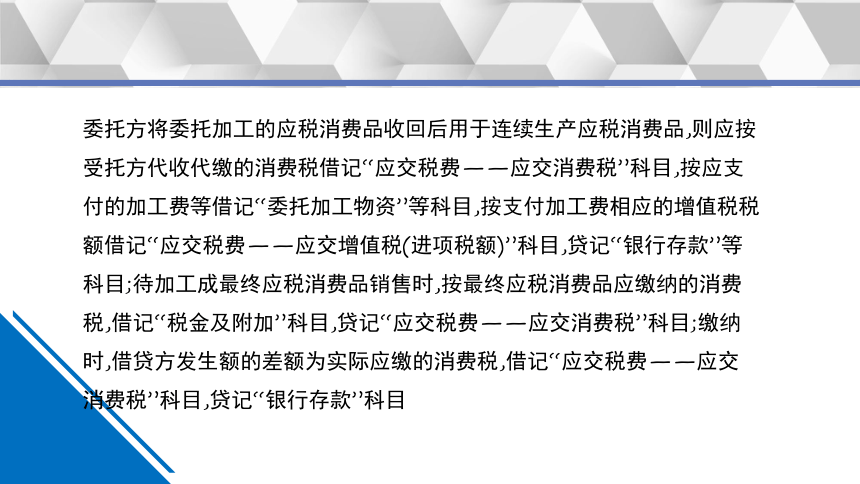

资源预览