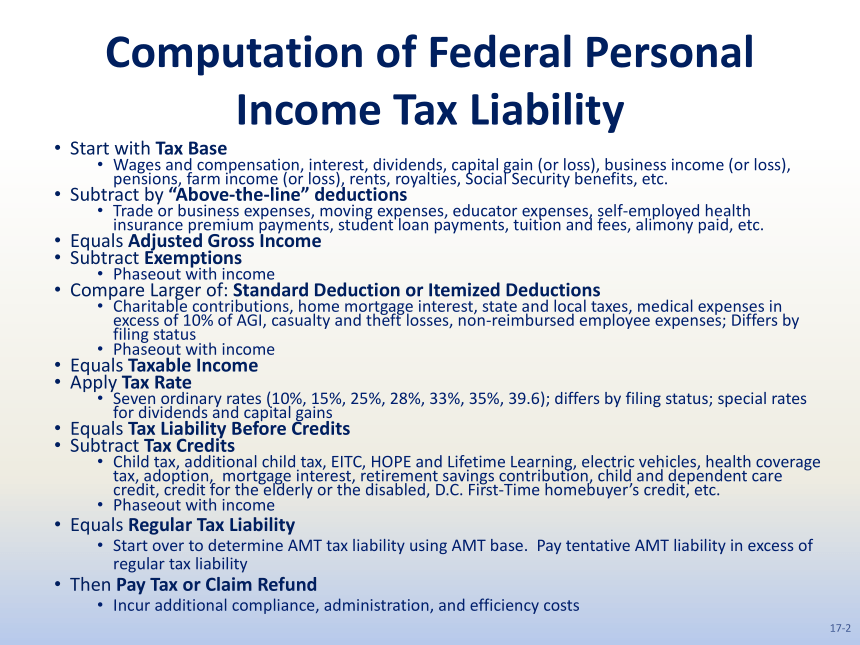

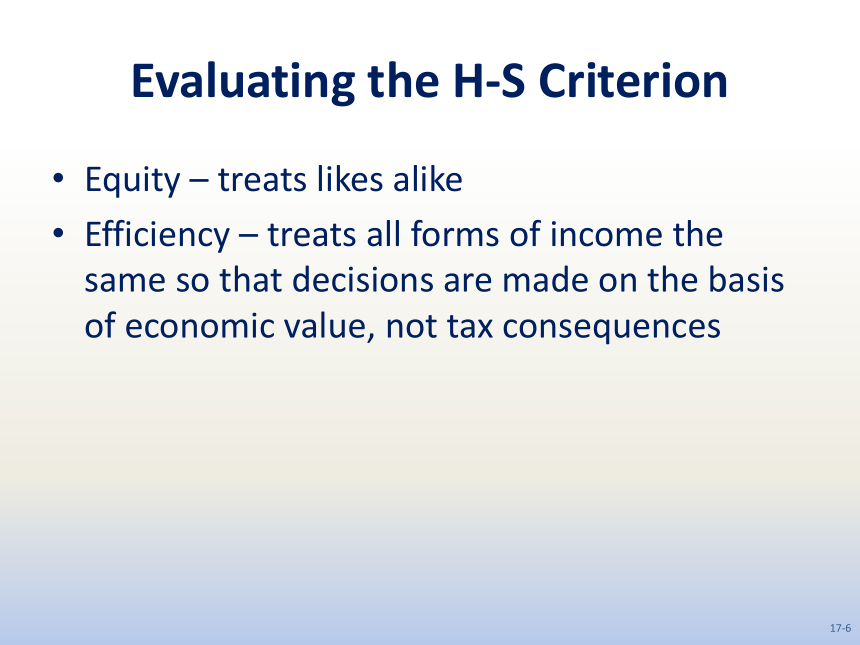

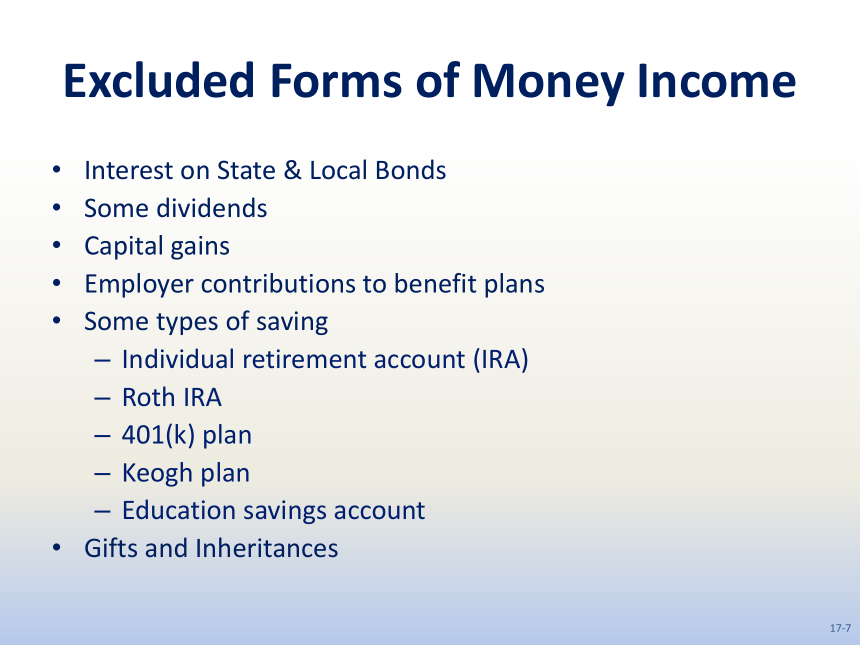

资源预览

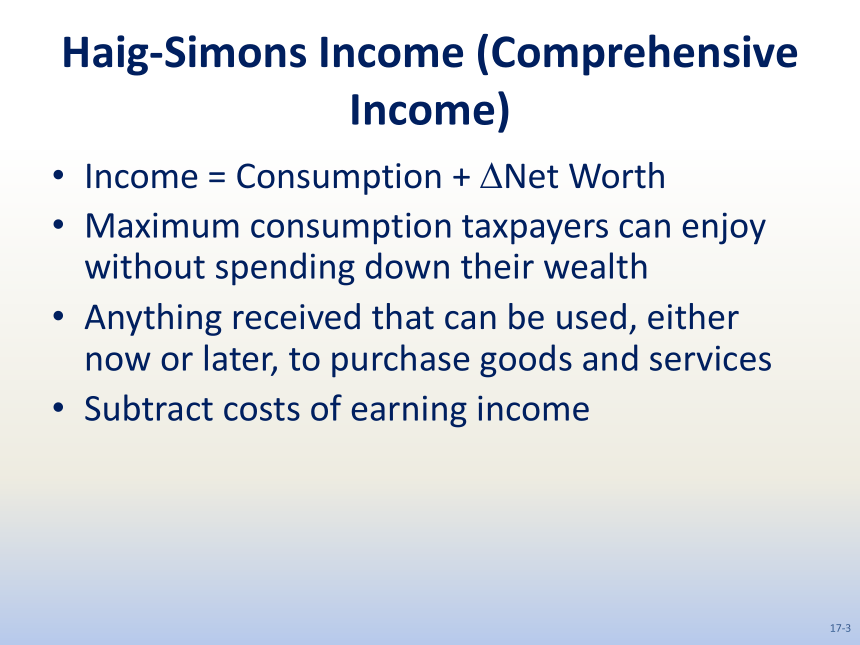

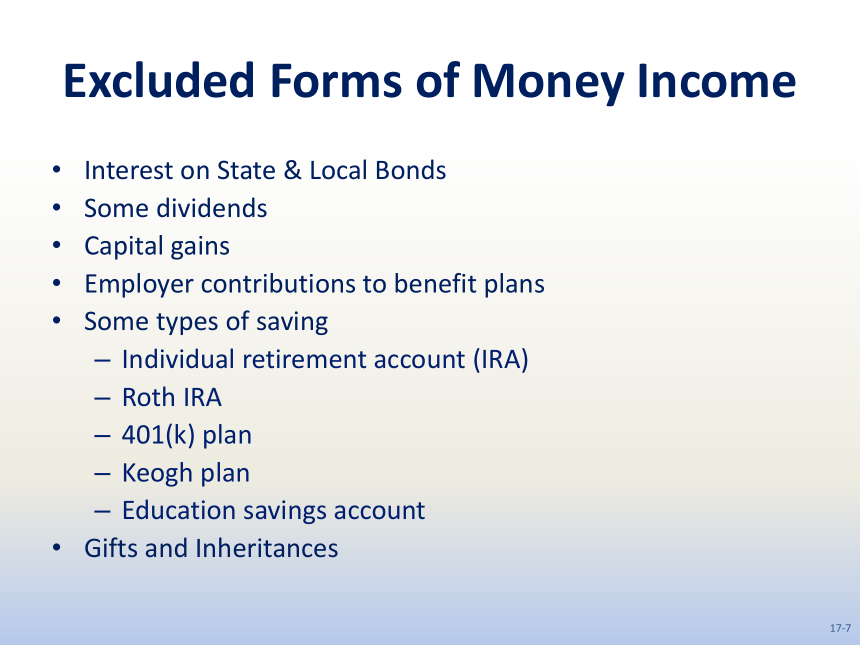

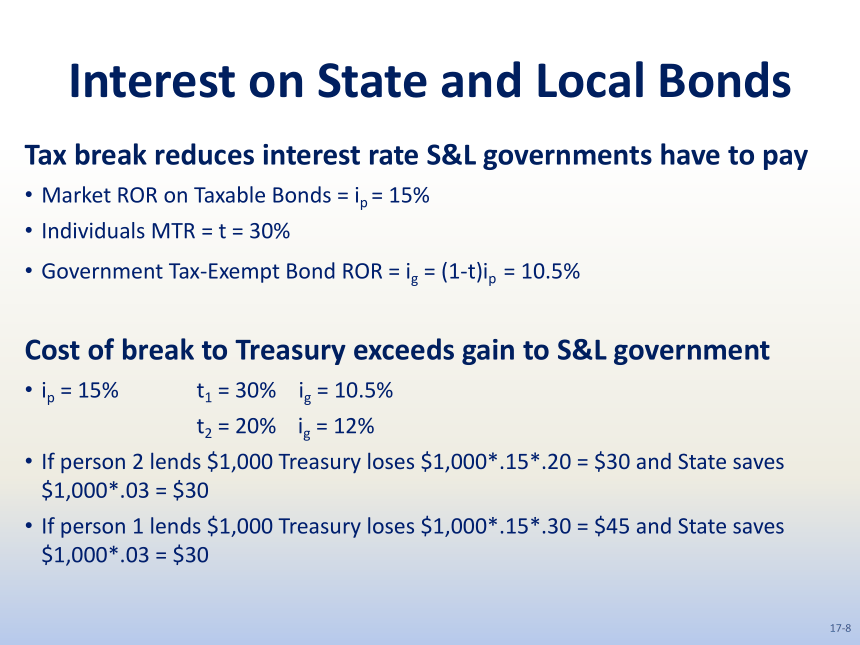

资源预览

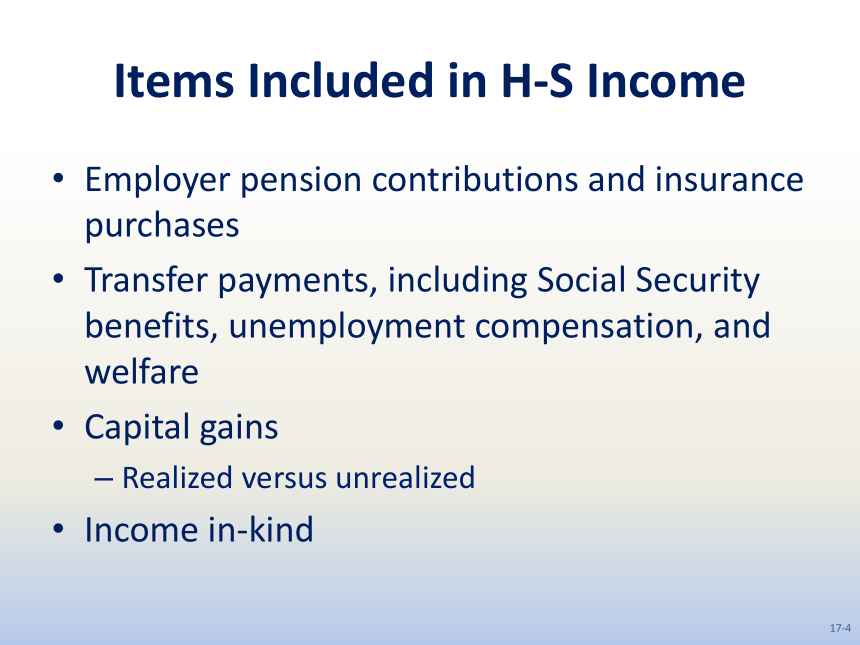

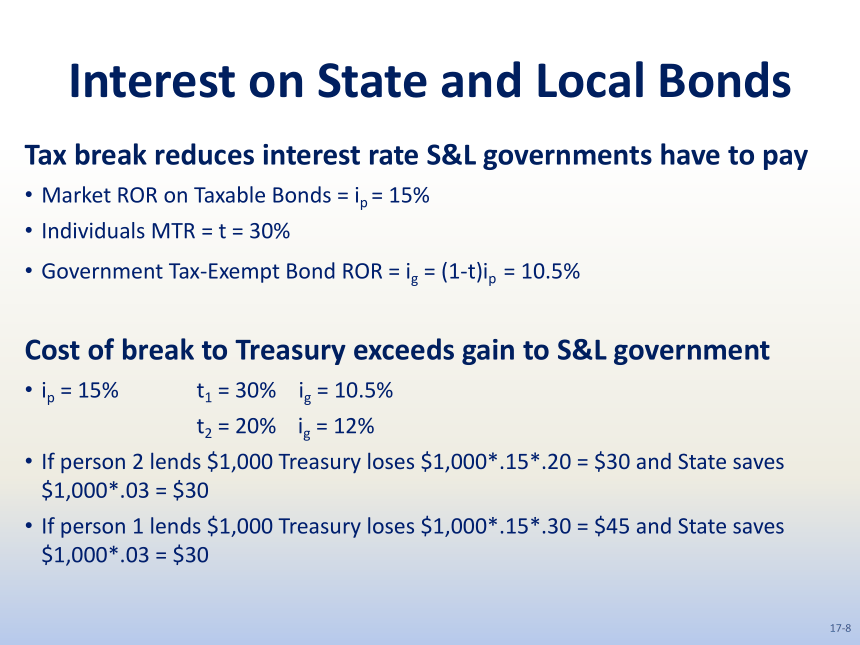

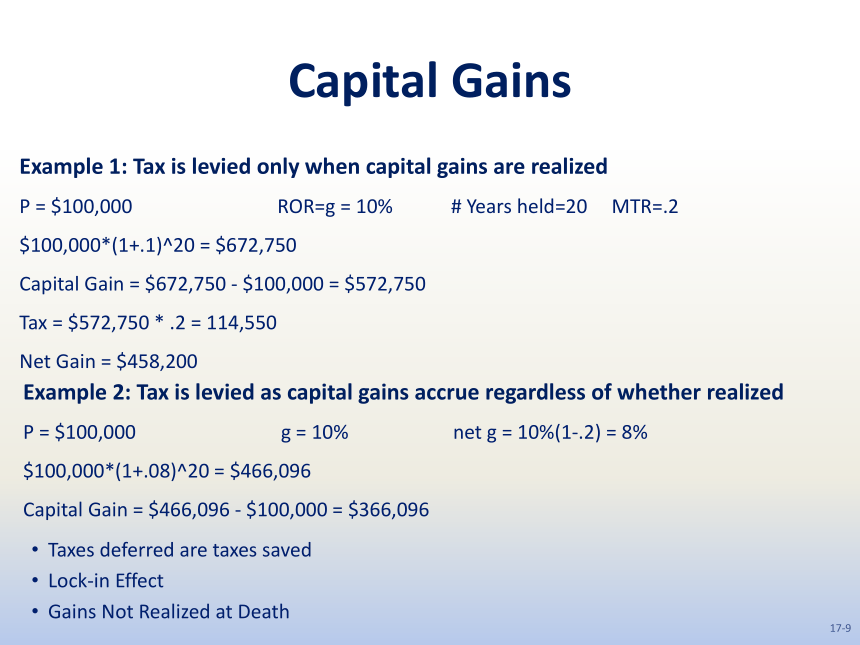

资源预览

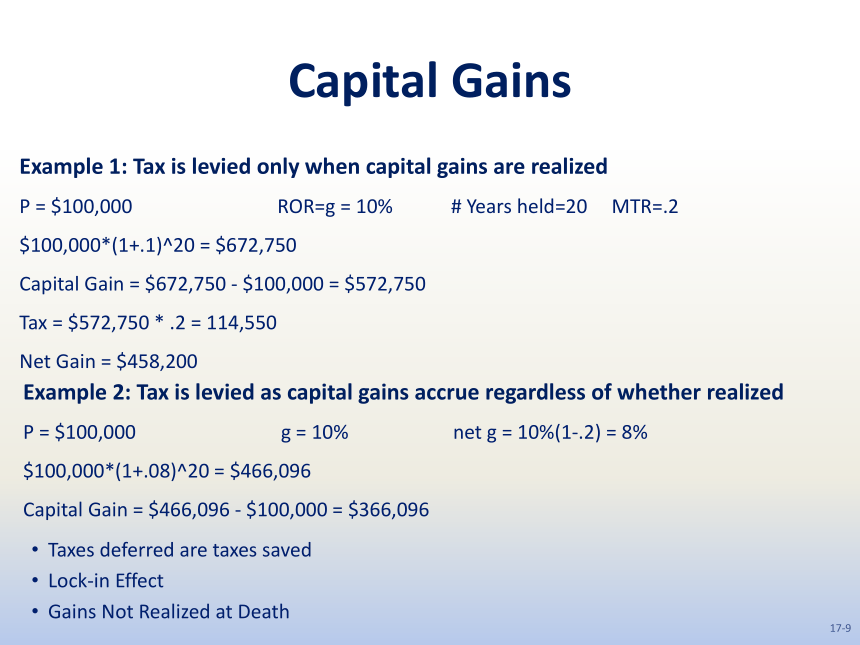

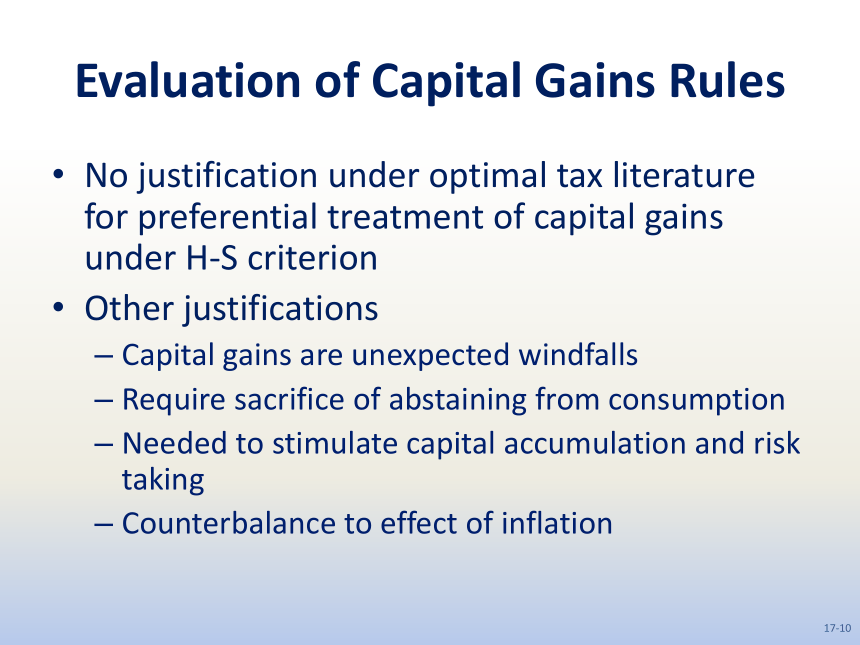

资源预览